Accelerate digital transformation in manufacturing

Navigate transformation and drive sustainable business value for an agile supply chain and manufacturing operations excellence.

Services & Consulting

On Time Edge helps manufacturing companies navigate every aspect of digital transformation – from making sense of all the technologies, to getting them up and running the right way, and everything in between.

We focus on fast time-to-value, and help you get the business results your company expects.

Our team partners with you after the work is done, so your company can continue to innovate and leverage project investments, long after your people turn the system on for the first time.

Apps that help you do better, not take up time and resources

We focus on getting systems up and running, so you can focus on getting the business results your company expects.

Featured Partners

Manufacturing

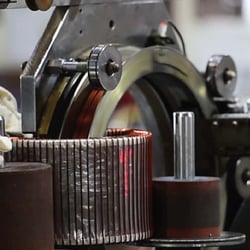

Industry Expertise

Manufacturing companies today are eager to achieve operational excellence so they can operate profitably. However, performance improvement isn't a one-size-fits-all proposition. Every industry sector has unique challenges, priorities, and opportunities. Learn more about how On Time Edge can help your company align culture, processes, and technology – in the plant, and throughout the entire business.

- flight Aerospace & Defense

- directions_car Automotive

- shopping_cart Consumer Goods

- local_cafe Food & Beverage

- emergency Medical Device

- gradient Metals & Metal Parts

- local_pharmacy Pharmaceutical

- sports_golf Plastics & Rubber

Helpful Resources

Let’s Connect